Hey, I’m Isaac 👋 I founded Pistachio, where we’ve worked with brands like BuzzFeed and Clay to understand their audience, build trust and deliver measurable outcomes through content-led growth.

If you want to chat about your own strategy, book a free call here.

The Negative CAC Media Pyramid

Howdy! I’m Bill Kerr, but most people just call me Doc. I’m the Founder and CEO of Athyna—we help companies all over the world grow faster by building amazing remote teams.

Over the years, I’ve had the chance to work with tons of founders and operators, learning what really moves the needle when it comes to growth. One of my favorite topics? Negative CAC. I’ve talked about it before on Open Source CEO, but today I want to break it down in plain English and show you how you can actually make it work for your business.

Today, I’m going to tell you something I shouldn’t—and if my team found out, they might come looking for you. Proceed at your own risk. I’m revealing a key strategy behind the Negative CAC engine we're building at Athyna. While our competitors struggle to fill pipelines, burning cash on Google and Meta ads, we’re laughing all the way to the bank by getting paid to acquire clients.

Yes, you heard me right: we're heading directly to Negative CAC territory.

CAC, but Not as You Know It

I have nothing personal against Customer Acquisition Cost (CAC). It’s just a vanilla metric—a figure lesser companies use because they haven’t found a way to have more money and more clients by month’s end. CAC is for mere mortals, and that’s okay.

But let's briefly clarify CAC before we redefine it: CAC covers how much a company spends to get a new customer. It includes Cost of Goods Sold (COGS) and indirect expenses like salaries, marketing budgets, and technology. Athyna, for instance, includes recruitment expenses alongside sales and marketing because it better reflects our actual costs.

6 months: rocket fuel. 24 months: cash bonfire.

Then there’s CAC Payback—the time it takes for revenue from a new customer to cover their acquisition cost. Companies with paybacks of six months or less scale aggressively. Those beyond two years? They might as well be burning money.

Payback | Rating | Prospects |

|---|---|---|

Six months or less | Amazing | These companies are highly scalable, and are able to quickly reinvest into compounding growth. |

Up to one year | Good | This would suggest a healthy balance between acquisition costs and customer revenue. |

12-24 months | Reasonable | Improvement needed here to either reduce CAC, improve retention, or increasing the average revenue per customer. |

More than 2 years | Bad | Reassessment of the business model is needed here, as this is often unsustainable long term. |

But imagine an alternative reality: instead of paying for clients, someone pays you to acquire them.

Technology → Media → Technology

Here's a simplified illustration: consider Robinhood’s acquisition of the daily newsletter, Snacks. Let's say Snacks has an audience of 100k subscribers, selling primary ads at $3k and secondary ads at $1k. In a week, Snacks generates roughly $15k in ad revenue.

Unsold ad slots are used internally, generating 1,000 new Robinhood users worth $1M lifetime value. The result? Robinhood's CAC becomes zero—or even negative—because the newsletter's external ads subsidize internal growth.

While these numbers are illustrative, the model is real. Stripe, Pendo, SEMrush—and Athyna—are successfully running versions of this exact playbook.

This cycle is how companies turn ad spend into an engine that pays for itself—and then some.

A Pyramid the Egyptians Would Be Proud Of

At Athyna, we've structured our Negative CAC strategy around a Media Pyramid consisting of four layers: founder brand, owned media, creator partners, and good-old-fashioned newsletter ads.

Let’s break down each layer…

1. Founder Brand

Scott Galloway recently noted that within 5–10 years, CEOs will be chosen partly based on their following. I agree. The foundation of our Negative CAC strategy begins with my personal brand—my LinkedIn (~30k followers) and my newsletter (~110k subscribers), engaging leaders from Canva, OpenAI, Google, and beyond.

My personal brand drives significant pipeline growth, serving as both top-of-funnel awareness and a trust accelerator for prospects ready to hire through Athyna.

2. Owned Media

Next, we’re building multiple daily tech news brands—in stealth, to avoid brand dilution. These brands generate tens of thousands in ad revenue monthly while consistently funnelling high-quality leads directly into our pipeline. The secret here? Using our media channels to run our own ads seamlessly.

3. Creator Partners

We recently raised a $2.5M round, mostly backed by newsletter creators like Bay Area Times and Strategy Breakdowns. Now, over a dozen influential newsletter operators have a vested interest in Athyna's success, generating more than 50% of our pipeline with precisely targeted prospects.

4. Newsletter Ads

Finally, we're aggressively investing in newsletter ads. Although it sounds straightforward, it's strategically powerful: we place Athyna’s story exactly where our ideal customers already consume content.

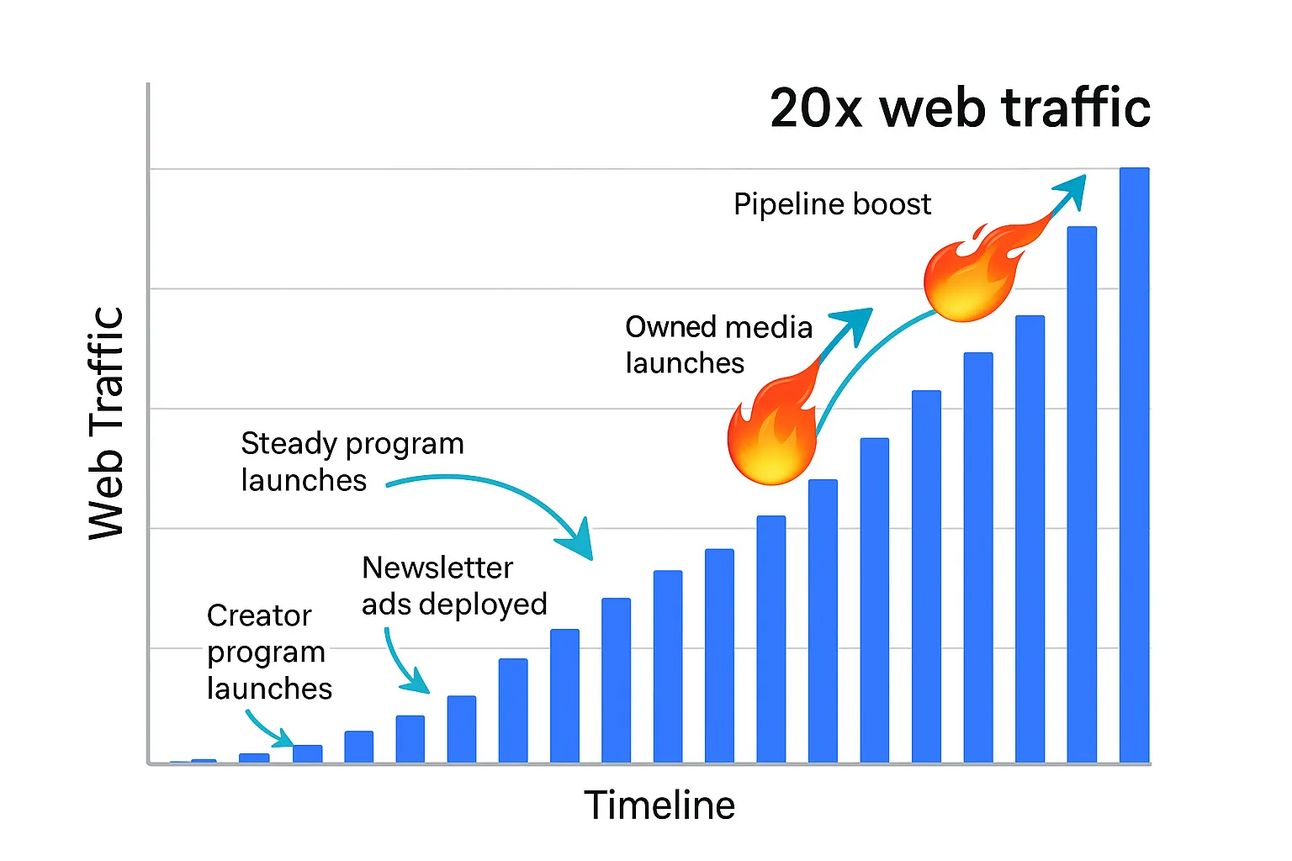

Early Results: 20x Web Traffic in 12 Months

The early numbers from our Negative CAC Machine speak volumes: in just 12 months, we've increased our web traffic by approximately 20x. Today, the majority of our pipeline originates from our multi-layered media strategy.

Ordinarily, I wouldn't share a tactic this critical. But I'm confident it’s incredibly tough to replicate—a unique blend of founder brand, media expertise, and creator relationships that I've refined over the years.

Still, Negative CAC isn’t beyond reach. Here’s your simplified playbook:

Build or buy quality media → Sell external ads → Run internal ads → Rinse → Repeat.

The Road Ahead

Months ago, I wrote about our ambition for my personal newsletter—to hit the scale and relevance of Lenny’s Newsletter or Morning Brew. Putting that goal in writing was nerve-wracking, but today I’m more confident than ever.

Looking forward, here’s what’s next in our Negative CAC playbook:

Scale the pyramid. Double down on our owned media outlets and creator partnerships to keep that pipeline pressure rising.

Optimize ad efficiency. We’ll test new sponsorship formats and placement cadences to squeeze even more pipeline out of existing inventory.

Refine founder content. Expect deeper dives, case studies, and live AMAs—because founder brand is the bedrock of compounding trust.

Measure—and share—the data. We’ll publish quarterly reports on CAC payback, pipeline mix, and traffic lift so you can benchmark against us.

When I first mapped out this strategy, it felt almost audacious. But as my dad always reminded me: “If you aim for the stars, the worst you can do is the moon.” Whether Athyna lands in the stratosphere or simply leaves a big crater, I’ll be reporting back every step of the way.

Final Thoughts

Negative CAC isn’t just another fancy marketing buzzword—it’s a genuine growth lever. When you shift from paying to acquire customers to getting paid to acquire them, you flip your marketing funnel upside-down and create a powerful engine of sustainable, scalable growth.

If you’re serious about building a team that can actually execute a Negative CAC strategy—leveraging media, partnerships, and founder-driven content—let’s talk. At Athyna, we've spent years perfecting exactly this type of growth playbook for companies all over the world. Drop me a DM on LinkedIn, or click here to learn how Athyna can help you build the remote dream team that drives real results.

If you enjoyed this post or know someone who may find it useful, please share it with them and encourage them to subscribe: brandchemistry.co/p/negative-cac-media-pyramid

Enjoyed this newsletter? Forward it to a friend and have them signup here.

That’s it from me!

Until next week,

Isaac Peiris

When you’re ready, here’s 3 ways I can help you

The Modern Media Masterclass walks you through how to use organic content channels to build your brand and business.

Get the clarity and direction you need to turn content into a growth engine that drives brand trust and business results. Flat fee. No contracts. No lock-ins.

I’ve worked with brands like BuzzFeed and Clay to launch, grow and monetise organic content channels that drive real business results. Book a call today and lets see how I could help you.